Natali_Mis

Dividend advancement investing will not constantly have to be with common names these kinds of as Microsoft (MSFT) or Apple (AAPL). That is for the reason that the long run is constantly full of unknowns, and it will choose several a long time ahead of an investor will achieve a healthy generate on expense from getting at today’s selling prices.

That is why it may possibly be helpful to get into a inventory that also has a attempted-and-genuine business enterprise product merged with a significant beginning yield. This brings me to Progress Car Sections (NYSE:AAP), which was a highflyer that is now fallen on tricky moments.

As shown earlier mentioned, AAP has fallen by 38{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} since the start of the 12 months, and in this write-up, I emphasize why this presents an superb option for worth investors, so let’s get started off.

Why AAP?

Progress Vehicle Elements is a main pieces supplier for the automotive aftermarket, serving both equally Diy clients and specialist installers alike. At existing, it operates above 4,747 outlets and 313 WorldPac branches mainly in the U.S., Canada, and Puerto Rico. AAP also serves 1,335 independently owned Carquest branded merchants, furthering its reach to extra prospects and markets.

AAP’s large retail outlet community serves as a excellent protection versus e-commerce players like Amazon (AMZN). Which is because customers are extra very likely to pay a visit to a locale to obtain their elements, the place there is in-household abilities and installation companies, which is really hard to replicate with on the net manuals and videos. AAP also has a software-personal loan program, which is practical for a customer’s just one-time specialised set up. This, merged with parts offered on demand, is in particular handy when a customer wants a component promptly to regain their use of their individual or professional car or truck.

Getting claimed that, AAP is observing some worries, as its third quarter (finished in Oct) similar gross sales were being down by .7{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} YoY. AAP’s working fundamentals have lagged its peers, as it continue to has an ongoing turnaround to make improvements to component availability and assistance degrees.

Moreover, inflationary products prices and unfavorable channel blend has pressured margins, as reflected by altered working margin declining by 68 basis points YoY to 9.8{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303}, down from 10.4{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} in the prior 12 months interval.

Even so, AAP continues to be a free of charge dollars movement producing equipment, returning $167 million to shareholders during the previous quarter in the kind of share dividends and buybacks (.4 million shares repurchased), bringing whole money returns to $860 million for the to start with nine months of the yr.

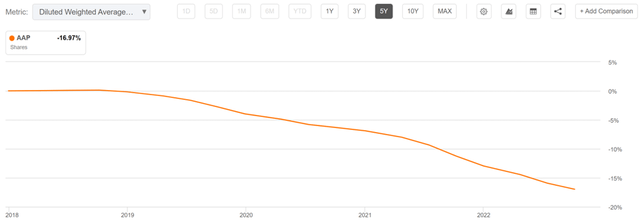

AAP has $1 billion in remaining authorization on this share repurchase system, and that’s instead substantial for a business with an $8.4 billion equity market place cap. As demonstrated underneath, AAP has decreased its share depend by a substantial 17{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} above the previous 5 yrs on your own.

AAP Shares Excellent (Searching for Alpha)

On the lookout ahead, administration has expressed dissatisfaction with prime line overall performance and introduced strategic initiatives to put the organization on firmer footing, as highlighted all through the latest conference contact:

As we establish ideas for 2023 and past, we’ve carried out a deep dive on the competitive ecosystem and the steps important to accelerate expansion. From our investigation, two options arrived to the forefront, especially in the expert sales channel. First, we have chances on availability in specific classes, which involve stock financial commitment to permit us to get a lot more SKUs nearer to the buyer.

Secondarily, when our exploration has continually indicated that value is not the most crucial driver of preference for specialist shoppers, we’ve tested and will make surgical pricing steps in selected groups to empower us to much better tackle alterations in competitive pricing dynamics.

Meanwhile, AAP maintains a BBB- expenditure quality rated stability sheet, and pays an beautiful 4.2{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} produce at the present-day selling price, which is nicely-protected by a 45{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} payout ratio. Management is obviously prioritizing shareholder returns, as the $1.50 quarterly dividend charge this 12 months was appreciably ramped up from the $1.00 charge final 12 months. Supplied that the dividend was past lifted in February, I would hope to see yet another elevate in the early months of 2023.

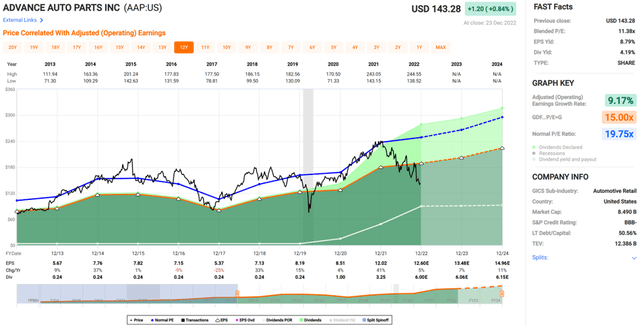

I also believe AAP’s headwinds have been additional than baked into the latest share rate of $143 with a ahead PE of 11.4. As demonstrated beneath, this sits perfectly underneath AAP’s ordinary PE of 19.8. Analysts have a consensus Invest in score on the inventory with an normal price tag concentrate on of $173, equating to a probable 25{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} whole return from the latest price tag.

AAP Valuation (Fast Graphs)

Trader Takeaway

AAP’s functioning fundamentals have lagged its marketplace friends, and its share rate effectiveness is deeply in the red for the yr. On the other hand, management is proactively getting measures to handle its troubles while prioritizing shareholder returns. It appears that AAP’s close to-time period headwinds have been additional than priced into the inventory, offering value traders a respectable starting up generate around 4{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} and likely sturdy total returns from listed here.

More Stories

Understanding Mileage Blockers: Technology, Ethics, and the Road Ahead

GPS lap timer – how does it works?

Dana auto parts workers hold meeting series in Toledo to organize joint fight back with Jeep workers