Progress Vehicle Components, Inc. (NYSE:AAP), is not the major company out there, but it gained a whole lot of consideration from a considerable selling price movement on the NYSE in excess of the final few months, growing to US$157 at a single point, and dropping to the lows of US$111. Some share value movements can give traders a improved chance to enter into the inventory, and likely buy at a reduced value. A question to respond to is no matter if Progress Vehicle Parts’ existing investing cost of US$119 reflective of the genuine benefit of the mid-cap? Or is it at this time undervalued, giving us with the possibility to purchase? Let us consider a glimpse at Advance Auto Parts’s outlook and benefit dependent on the most latest fiscal information to see if there are any catalysts for a selling price improve.

See our newest analysis for Progress Car Sections

Is Advance Vehicle Sections Continue to Low cost?

Wonderful information for buyers – Progress Auto Pieces is however trading at a relatively low-cost rate. My valuation product reveals that the intrinsic worth for the stock is $173.51, but it is presently buying and selling at US$119 on the share marketplace, this means that there is continue to an opportunity to buy now. On the other hand, presented that Progress Car Parts’s share is pretty risky (i.e. its rate actions are magnified relative to the rest of the sector) this could indicate the rate can sink decreased, supplying us a different possibility to buy in the long run. This is centered on its substantial beta, which is a excellent indicator for share rate volatility.

What kind of expansion will Advance Car Parts deliver?

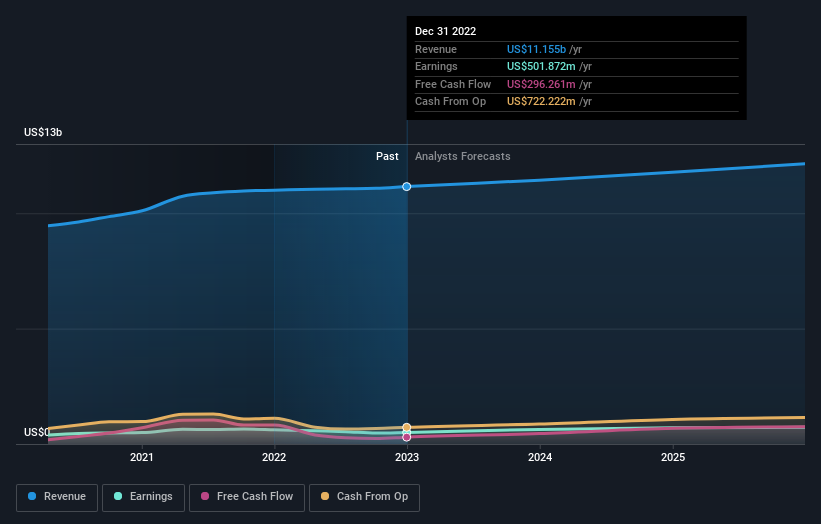

Buyers searching for advancement in their portfolio may want to contemplate the prospective customers of a corporation just before shopping for its shares. Acquiring a excellent company with a sturdy outlook at a inexpensive selling price is always a excellent financial investment, so let’s also take a appear at the firm’s future anticipations. Progress Automobile Parts’ earnings about the subsequent few a long time are predicted to enhance by 44{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303}, indicating a remarkably optimistic long run forward. This need to direct to additional robust hard cash flows, feeding into a greater share price.

What This Means For You

Are you a shareholder? Considering the fact that AAP is at the moment undervalued, it may possibly be a wonderful time to accumulate additional of your holdings in the inventory. With a beneficial outlook on the horizon, it appears to be like this development has not however been thoroughly factored into the share rate. On the other hand, there are also other aspects these types of as monetary well being to think about, which could demonstrate the present-day undervaluation.

Are you a probable trader? If you’ve been retaining an eye on AAP for a even though, now might be the time to make a leap. Its affluent future outlook is not absolutely reflected in the recent share price however, which signifies it’s not much too late to get AAP. But ahead of you make any expense conclusions, look at other variables these as the power of its harmony sheet, in get to make a properly-knowledgeable expenditure selection.

So although earnings high quality is crucial, it really is equally critical to consider the threats facing Advance Car Pieces at this point in time. Case in position: We have noticed 2 warning indications for Progress Car Areas you need to be knowledgeable of.

If you are no for a longer time interested in Progress Car Parts, you can use our totally free platform to see our listing of above 50 other stocks with a higher advancement potential.

Valuation is sophisticated, but we’re aiding make it straightforward.

Discover out whether Progress Auto Areas is most likely in excess of or undervalued by checking out our in depth analysis, which consists of fair value estimates, hazards and warnings, dividends, insider transactions and economic wellbeing.

Check out the Free Examination

Have feedback on this posting? Involved about the content? Get in touch with us immediately. Alternatively, email editorial-workforce (at) simplywallst.com.

This write-up by Just Wall St is typical in character. We supply commentary centered on historical info and analyst forecasts only using an impartial methodology and our posts are not intended to be fiscal advice. It does not constitute a recommendation to acquire or promote any stock, and does not take account of your aims, or your financial circumstance. We aim to bring you prolonged-time period centered examination pushed by fundamental data. Notice that our evaluation may perhaps not issue in the newest price-sensitive business bulletins or qualitative product. Simply Wall St has no placement in any stocks mentioned.

More Stories

Understanding Mileage Blockers: Technology, Ethics, and the Road Ahead

GPS lap timer – how does it works?

Dana auto parts workers hold meeting series in Toledo to organize joint fight back with Jeep workers