If you happen to be not sure where to begin when hunting for the future multi-bagger, there are a several important tendencies you need to keep an eye out for. Firstly, we are going to want to see a proven return on capital utilized (ROCE) that is expanding, and secondly, an expanding foundation of cash employed. In essence this signifies that a firm has profitable initiatives that it can carry on to reinvest in, which is a trait of a compounding device. So, when we ran our eye in excess of Advance Car Parts’ (NYSE:AAP) craze of ROCE, we liked what we saw.

Knowledge Return On Money Used (ROCE)

For people that are not guaranteed what ROCE is, it measures the quantity of pre-tax income a corporation can create from the capital employed in its business enterprise. Analysts use this method to calculate it for Progress Automobile Sections:

Return on Money Used = Earnings Just before Fascination and Tax (EBIT) ÷ (Complete Assets – Current Liabilities)

.11 = US$732m ÷ (US$12b – US$5.4b) (Primarily based on the trailing twelve months to Oct 2022).

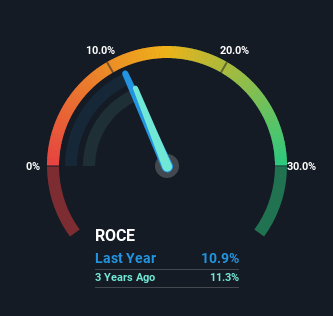

So, Advance Auto Parts has an ROCE of 11{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303}. In isolation, that is a pretty typical return but from the Specialty Retail sector regular of 17{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303}, it is really not as good.

See our most up-to-date assessment for Advance Car Areas

In the earlier mentioned chart we have measured Advance Car Parts’ prior ROCE from its prior general performance, but the future is arguably a lot more significant. If you would like, you can examine out the forecasts from the analysts masking Advance Automobile Elements in this article for cost-free.

What The Development Of ROCE Can Inform Us

While the returns on cash are very good, they have not moved considerably. The enterprise has continuously acquired 11{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} for the very last five years, and the capital employed in just the enterprise has risen 36{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} in that time. 11{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} is a fairly normal return, and it delivers some ease and comfort recognizing that Advance Vehicle Sections has continually gained this sum. Secure returns in this ballpark can be unexciting, but if they can be preserved above the extensive run, they often supply awesome rewards to shareholders.

One more point to note, Progress Auto Components has a superior ratio of recent liabilities to full assets of 45{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303}. This proficiently signifies that suppliers (or shorter-phrase collectors) are funding a large portion of the small business, so just be knowledgeable that this can introduce some features of threat. Though it can be not necessarily a poor point, it can be helpful if this ratio is lower.

Our Acquire On Progress Car Parts’ ROCE

To sum it up, Progress Automobile Components has simply just been reinvesting cash steadily, at these first rate prices of return. Nonetheless, about the past 5 a long time, the inventory has only delivered a 37{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} return to shareholders who held about that period. That is why it could be worth your time looking into this stock further more to discover if it has far more attributes of a multi-bagger.

On a separate notice, we have discovered 2 warning signals for Progress Vehicle Areas you’ll probably want to know about.

While Progress Car Components isn’t really earning the maximum return, verify out this cost-free listing of companies that are earning higher returns on fairness with reliable stability sheets.

Valuation is sophisticated, but we are supporting make it easy.

Uncover out regardless of whether Progress Auto Components is likely more than or undervalued by checking out our detailed examination, which features fair value estimates, challenges and warnings, dividends, insider transactions and money wellness.

View the Absolutely free Examination

Have opinions on this short article? Involved about the articles? Get in contact with us specifically. Alternatively, email editorial-group (at) simplywallst.com.

This report by Basically Wall St is general in character. We present commentary dependent on historical info and analyst forecasts only using an impartial methodology and our articles are not intended to be economical information. It does not constitute a suggestion to get or promote any stock, and does not get account of your goals, or your fiscal problem. We goal to provide you long-term concentrated examination pushed by elementary details. Note that our investigation may possibly not component in the newest rate-sensitive organization announcements or qualitative content. Just Wall St has no placement in any shares stated.

More Stories

Understanding Mileage Blockers: Technology, Ethics, and the Road Ahead

GPS lap timer – how does it works?

Dana auto parts workers hold meeting series in Toledo to organize joint fight back with Jeep workers