The Zacks Retail and Wholesale sector has modestly underperformed relative to the S&P 500 in excess of the final year, down about 15{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303}.

1 business residing in the sector, Advance Car Elements AAP, has viewed its earnings outlook shift negative more than the last several months, pushing the stock into a Zacks Rank #5 (Powerful Offer).

Picture Supply: Zacks Expenditure Study

Progress Car Pieces mainly sells substitute sections (excluding tires), extras, batteries, and routine maintenance objects for domestic and imported automobiles, vans, activity utility automobiles, and light-weight and hefty-responsibility trucks.

Let us take a deeper dive into how the enterprise designs up.

Share Efficiency

Around the very last year, AAP shares have broadly lagged driving the S&P 500, down extra than 30{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303}.

Picture Resource: Zacks Financial investment Study

And over the last three months, sellers have remained in regulate, with shares down 13{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} and all over again lagging behind the typical sector.

Graphic Supply: Zacks Expenditure Research

Quarterly Outcomes

Progress Auto has struggled to come across consistency inside its quarterly final results, slipping small of the Zacks Consensus EPS Estimate in back-to-back again quarters. Best-line benefits have also remaining some to be wanted, with AAP lacking income anticipations in 3 consecutive quarters.

Just in its latest launch, the enterprise fell quick of earnings expectations by about 15{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} and claimed gross sales marginally down below estimates.

Picture Source: Zacks Financial commitment Investigation

Growth Outlook

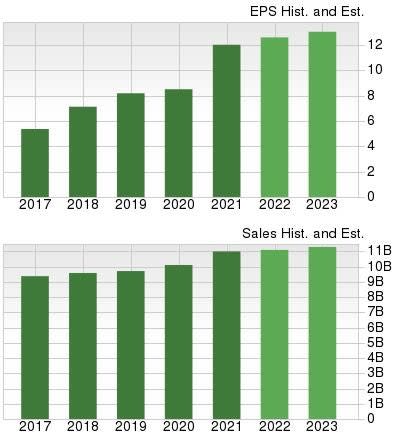

Irrespective of its earnings outlook coming underneath tension, AAP nevertheless carries a respectable progress profile, with earnings forecasted to climb 5{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} in its current fiscal yr (FY22) and a further 5.4{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} in FY23.

The projected earnings growth comes on major of forecasted Y/Y earnings upticks of 1{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} in FY22 and 2.6{ca2182fc8fed51dc37b95061ee48b5056cde1176732b225548c54a0c0156d303} in FY23.

Graphic Supply: Zacks Expenditure Investigate

Base Line

Inconsistent quarterly results and unfavorable earnings estimate revisions from analysts paint a tough photograph for the business in the in the vicinity of time period.

Advance Car Sections AAP is a Zacks Rank #5 (Strong Market), indicating that analysts have lowered their base-line outlook across the very last many months.

For people searching for solid shares, a good strategy would be to target on shares carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Purchase) – these shares sport a notably stronger earnings outlook paired with the prospective to supply explosive gains in the near term.

Want the most up-to-date recommendations from Zacks Financial commitment Study? Now, you can download 7 Most effective Stocks for the Following 30 Times. Simply click to get this free of charge report

Advance Car Sections, Inc. (AAP) : Totally free Stock Evaluation Report

More Stories

Understanding Mileage Blockers: Technology, Ethics, and the Road Ahead

GPS lap timer – how does it works?

Dana auto parts workers hold meeting series in Toledo to organize joint fight back with Jeep workers